The PEO will manage payroll and other administrative services, and will often also offer employee benefits. It may also offer services for employees in multiple how many years can you file back taxes states or even multiple countries. Bambee combines HR outsourcing services and software to provide a basic system to manage payroll and labor law compliance.

Run payroll around the world from one platform, streamline international operations, and eliminate the ongoing admin of local compliance, taxes, benefits, and more. Having an international team increases innovation, creativity, and diversity—but it also complicates payroll management. You have to navigate different currencies, exchange rates, bank laws, and compliance requirements.

ADP helps companies manage payroll taxes by automating deductions from employee wages and making sure the right amount of money is delivered to the government, based on the latest payroll tax rules and regulations. A New York- or San Francisco-based company that keeps payroll in-house, for example, must pay “big city salaries” to attract the right employees for managing payroll, just like the rest of its internal workforce. If many hours of work can instead be assumed by third-party employees somewhere with a lower cost of living, the outsourced functions tend to become cheaper to perform. “Payroll co-sourcing” describes a hybrid model in which some elements of the payroll process are hired away while others are completed in-house. When selecting an outsourced payroll provider, consider your budget, expansion goals, and payroll team’s bandwidth. Whether you’re running payroll domestically or internationally, you must ensure you’re operating in compliance with the employee’s payroll laws.

Users say the software is extremely easy to use and has comprehensive features. They also say TriNet’s customer support is responsive (responding within just minutes of inquiry submission) and knowledgeable. However, they do not like that the platform experiences frequent reporting glitches and they wish it offered more integration options. TriNet’s standout features include automated tax and filing support, unlimited payroll runs, a mobile app and time and attendance tracking.

It also includes managing information relevant to the tax process such as health insurance and workers’ compensation claims. Ensuring that your payroll partner has top-quality security measures in place is therefore one of the most vital factors to account for in your selection process. According to HR Dive, 61% of respondents outsourced payroll processing in 2022. And what are the pros and cons of taking this step for your business?

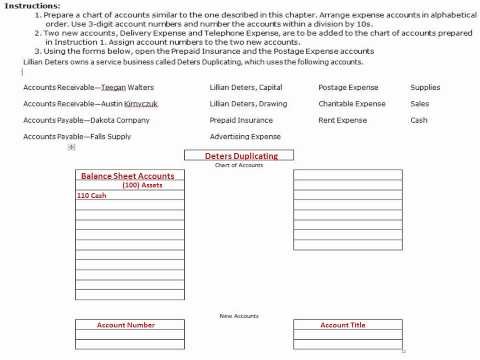

How do I choose the best accounting software for my business?

If you’re just using software, either the tool can pay your people or it can’t. There are plenty of features, functionalities and benefits that a given business might need from their payroll support vendor. We’ve focused on just a few, to highlight some of the most common (and most commonly needed) answers to HR and payroll pain points. Faster, easier, more reliable HR and payroll solutions designed to help you focus on what matters. You need comprehensive payroll and HR solutions that empower your people and unlock your teams’ potential. Any systems that must sync to derive this data, such as time clock software or systems, happen fair value vs market value automatically, so I didn’t have to worry about any of those processes.

- Wave doesn’t offer benefits administration, a major drawback, but its recent purchases of companies across the financial sector and its 2019 acquisition by H&R Block promise more capabilities and features to come.

- And, with the ability to pause the subscription, it is great for service companies such as landscapers who hire contractors often and endure off-seasons.

- From this screen, I was also given the option to import time tracking data from ADP’s time and attendance add-on or another time keeping software.

- If your current system causes frequent mistakes, you may want to consider outsourcing your payroll.

Are you a software provider looking to add more value to your tech?

Sometimes, you just need someone to take a few things off your hands. Business activities like running payroll are, obviously, a bit more involved and sensitive than, say, having someone run your personal mail to the post office. That said, at a fundamental level, outsourcing payroll or leveraging HR software solutions are in many ways the same as hiring someone to do your yardwork.

Top benefits of outsourcing payroll services

However, they say that the software does not offer enough customization options, nor does it offer detailed reporting to meet their needs. They also say its customer support is unhelpful; the chat bot does not offer relevant solutions and when they email customer support, it often doesn’t, either. They say the limited features the platform offers makes it a good option for companies with five to 10 employees but no more. TriNet has a 3.8 and 4.0 star review on Capterra and G2 respectively, with 649 user reviews total.

Take Your Time

“What made Deel stand out for SafetyWing was the extreme focus on the customer and how friendly and easy it is to use the platform. Definitely the best I have seen in this category,” said Karl Schroeder, Head of Finance at SafetyWing. SafetyWing is a health insurance provider for remote workers and teams. Payroll errors can negatively impact your workers, disrupting their budgets and lives and causing unnecessary stress. Payroll mistakes and delays can also dilute their trust and positive perception of your organization and lead them to question your financial status and management capabilities. Processing payroll and maintaining compliance standards is machine studying difficult for overwhelmed payroll departments, especially if their organization is growing quickly.

Payroll management can be complex, time-consuming, resource-intensive, and expensive. Plus, getting payroll in-house wrong can lead to severe implications ranging from financial penalties to negative employee experiences. Rather than having an in-house team deposit paychecks, calculate tax withholdings, and file your small business taxes, outsourced payroll handles it all behind the scenes.