As i review in the the individuals decades, though these were often trying to, they were a few of the happiest of our own lifetime. This is the conclusion I would personally need my students to reproduce: Alive within your means. Save for a rainy day. Manage clickcashadvance.com personal loan rate a resources which is generally categorizing and mindfully allocating their spending so you can some thing which might be important to your. However, making certain that you are taking care of the children’s studies was towards the top of the list. In suggestions back at my high school students, I might throw in particular Stoic skills, in that joy originates from in search of everything you have. As soon as your first needs is actually out of the way, procedure some thing promote little pleasure.

Chairman Biden, which have a professional buy (a decision one to did not experience Congress) forgave $10,000+ of several students’ finance. As well as the proven fact that all member of my personal domestic, plus my personal 8-year-old daughter Mia Sarah, is now on the hook for about $step one,000 for it forgiveness, they decided exactly what Rachel and i also was in fact seeking illustrate the high school students happens to be dumped the fresh windows.

That it loan forgiveness is actually a potentially dangerous, slippery slope. Some commonly argue it been with Uncle sam bailing the actual larger finance companies in the Higher Overall economy. Which is controversial, so there are a handful of important variations: Government entities failed to forgive financial institutions or give them money however, given high-notice fund. The government appeared in the future finally. Probably, in the event your All of us hadn’t bailed away its creditors, our very own entire cost savings would have crumbled. Yet not, I’m sure these types of subtleties is actually some destroyed, due to the fact personal investigates the newest government’s tips as a bailout. This establishes a risky precedent. Sure, the federal government appeared ahead, it have shed money.

Next, within the pandemic, government entities unsealed the entranceway large-open by throwing trillions of bucks at anybody and you may one thing having a bank account with a multi-trillion-buck PPP shower. Probably, this is needed facing a major international disaster, though the magnitude and you will pursue-upwards stimuli are available to debate. Even though this day in the authorities wished to guarantee that everyone got the bucks (besides unwanted fat cats to your Wall Road), due to the ineptitude a lot of it currency try misappropriated. Certain were showered with more PPP currency as opposed to others.

Dont worry about it, Uncle sam and you can Mia Sarah can come towards the conserve; might forgive those individuals fund

Today today, anyone who visited college or university, keeps student loan financial obligation, and produces lower than $250,000 per year (per couple) gets forgiveness off Uncle sam and you may my child Mia Sarah.

But what if you aren’t lucky enough having an excellent household but have a hill of credit card debt?

So it exec buy does not even make an effort to enhance new key situation out of runaway rising prices inside the educational costs. Actually, it does probably make university fees inflation tough from the organizing alot more taxpayer money at universities and you may result in limitless forgiveness later.

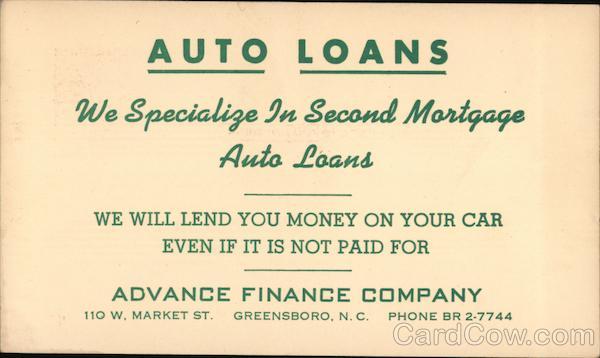

Exactly what towards plumbing professional or truck driver just who never ever went to college which means does not have any school financial obligation in order to forgive? That it where in actuality the slippery hill can become a huge landslide. He or she is second. Since the interest rates go up, some body wade ugly on their property and you may home loan attention cripples them. Don’t be concerned, you are absolved ones sins, also you won’t remain trailing.

In the meantime, folks who are for example Rachel and i also were twenty years ago, people that stop vacations, the autos, Starbucks frappuccinos and you will Chipotle burritos to store due to their offsprings’ knowledge is incentivized to do the exact opposite. Why annoy?