Va Loan against FHA versus Antique: What type Is the best?

Which is the better if you’d like to pick a home: A great Virtual assistant financing, FHA mortgage, or a conventional loan? A fast respond to may look such as this:

Virtual assistant loan: Use when you yourself have eligible U.S. army solution, generally 3 months from energetic responsibility otherwise six age in the National Shield or Supplies. Such money fundamentally render finest prices and you may words than just FHA or old-fashioned.

Va versus FHA against Conventional Assessment

It’s easy to see why people carry out favor an effective Va financing whether they have qualified army provider: straight down pricing, zero down payment, no monthly financial insurance policies.

Va Mortgage: Disregard This one For those who have No Army Services However, See Very carefully When you do

When you have no military provider, you certainly do not need to analyze upon Virtual assistant finance. Because they offer fantastic words, you truly need to have offered becoming qualified, zero exclusions.

Va Financing Advantages

Basic, so it loan boasts down cost than just FHA or conventional. According to Optimum Bluish, a mortgage app providers that songs pricing round the thousands of loan providers, rate averages on the first one-fourth off 2023 are listed below:

You may have almost certainly observed the term refinancing otherwise debt consolidation reduction, best?

You’ve got come viewing a few refinancing ads lately. not, just what people adverts you should never generally display is what the actual benefits, can cost you, and you may considerations was whenever refinancing. Therefore, i’ve waiting a blog detailing the advantages of refinancing thus to create the best choice on which is right to you.

Are you presently questioning for many who you will definitely spend smaller for your home loan or mortgage whenever there are ways to reduce your expenses each month?

Consumer debt is illustrated within the handmade cards and personal money

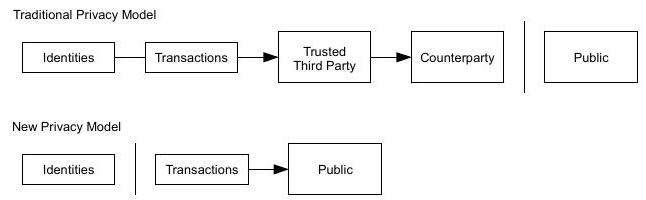

Protected debt provides a new reputation in the bankruptcy proceeding. The original concern many people enjoys are what exactly is protected financial obligation? In other words, its people personal debt which is secured of the possessions. The most used examples was house and you may automobiles. Your debt one to underlies such possessions is secure by the possessions. Which is, if you don’t spend their mortgage or car repayment, the mortgage team otherwise finance company takes right back the safety to offset its loss.

If you don’t spend their credit card otherwise consumer loan, the newest boat finance companies can sue both you and possibly realize one thing such as for instance bank accounts, however they never pursue whatever you ordered toward borrowing from the bank cards and/or mortgage.