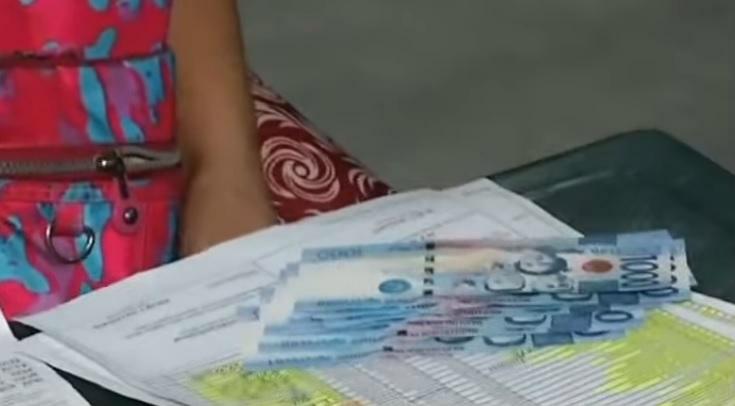

Make sure you know the potential risks on it before committing so you’re able to financing

Explore option borrowing from the bank choice: Before you apply to own a vehicle label loan, speak about most other borrowing possibilities for your requirements

cuatro. See the outcomes off defaulting on the costs: Defaulting towards car identity loan repayments have serious outcomes, such as the repossession of one’s vehicle. Envision alternative choices particularly settling to have down rates of interest otherwise expanded cost attacks to attenuate the likelihood of defaulting.

5. Consider conventional loans from banks, unsecured loans, if not borrowing from family relations or family. This type of choices can offer far more good conditions minimizing rates of interest, decreasing the monetary burden in the long run.

6. Assess the worth of your vehicle: The total amount you can use as a consequence of an automobile identity loan is generally according to the worth of your car. measure the economy value of your car or truck to find the limit amount borrowed we provide. Keep in mind that loan providers may only provide a share out-of your own automobile’s worthy of, making it crucial that you provides realistic expectations.

eight. Assess the complete price of the mortgage: Before signing your choice, calculate the price of the borrowed funds, such as the principal matter, appeal, and you may any additional charges. This will give you an obvious comprehension of all round economic connection youre makingpare it costs with your funds and you will assess be it a viable option for you.

Think of, a car label loan should be an important tool whenever utilized sensibly along with times of legitimate you would like.

Covering the level and you may depth out-of a flat, the latest record scrutinizes points crucial towards the structure’s durability and you can occupants’ cover

On the sensitive harmony off protecting a house and guaranteeing their long-label well worth, these types of inspections serve as a compass; it browse united states throughout the landscapes from potential risks which may if you don’t sacrifice new stability away from a precious condo. The fresh FHA inspection number isn’t just a different sort of techniques; it will act as a protector off housing safety and health, confirming your ecosystems inside condo’s walls is operating precisely before a debtor commits to control with the monetary responsibility off home financing.

Learning the newest FHA Condominium Check Listing

Navigating the fresh FHA condominium review list was comparable to assembling an intricate puzzle one, after finished, versions a very clear image of a beneficial property’s worthiness having a keen FHA-recognized funding.

Roof and structural ethics get a primary just right so it record, while the homes issues one coverage families should weather brand new storms off go out in the place of attaching.

Similarly critical will be electrical, heating, and you will plumbing expertise, hence should not simply means effortlessly however, follow newest safeguards requirements, deflecting risks eg outdated wiring or diminished heating.

Inside evaluating direct paint and termite presence, the list delves on safety dangers and you can environmental issues that’ll undermine the condition of citizens plus the property value disregard the.

Ultimately, the brand new number ensures the brand new dwelling’s property supply and location adhere to FHA conditions, offering each other a secure harbor and you can a sound monetary campaign having potential condominium owners.