nine. What are the alternative methods to use my personal family equity once the security to have a great

When you use your house guarantee because security to own a business loan, you happen to be able to find a diminished rate of interest than simply you might with a vintage business financing

One option you are offered is using your residence guarantee since the collateral to possess a business mortgage. It is that really a good notion?

Prior to i plunge to the though their wise to play with your residence guarantee once the collateral,let us very first make sure that had been for a passing fancy web page on what house collateral is actually.

Your home equity is the percentage of your home worth one you really own. Its the difference between exacltly what the residence is well worth and just how much you will still owe on the mortgage.

Eg,let’s say your home is worth $two hundred,000 therefore however are obligated to pay $100,000 on the home loan. In this situation, your property equity would be $100,000.

A business loan was financing that’s especially for company motives. Loans will come out of different supplies, in addition to financial institutions, borrowing from the bank unions, and online lenders.

Rescue Lawsuits: Latest Standing, Next Measures, and you can Techniques for Borrowers Navigating this new In pretty bad shape

Uncover the specifics of this new Cut lawsuits, away from judge rulings to help you potential situations, and get crucial advice about handling their college loans.

Your order regarding Eighth Routine Judge out of Is attractive was briefly blocking all aspects of your own Save yourself installment plan. Borrowers enrolled in Save will be given a destination-100 % free forbearance.

Secret Events about Cut Legal actions Schedule

One or two circumstances was basically submitted looking to cut off brand new Rescue payment bundle. You to instance was filed into the Missouri as well as the other when you look at the Kansas.

- 6/: Section judge judges inside Missouri and you may Kansas for every point preliminary injunctions about your Help save plan. One legal inhibits forgiveness less than Save your self just like the most other court reduces the 5% calculation to own consumers having undergraduate financial obligation.

- 6/: New 10th Circuit Judge out-of Is attractive affairs an order enabling the latest Agency regarding Studies to go pass on the 5% computation to own student financial obligation. Which overruled the brand new Kansas courtroom who initially provided the fresh first injunction.

- 8/9/24: New Eighth Routine prevents every forgiveness, interest subsidies, in addition to discretionary money formula significantly less than Save your self.

- 8/: The government data files a crisis demand into Supreme Courtroom asking into Save your self plan to be reinstated.

- 8/: The latest Ultimate Judge declines to intervene towards the first injunction. It does remain in effect until the situation was resolved.

Just how Pennymac try navigating this new double-edged sword away from all the way down prices

- Simply click to share on LinkedIn (Opens from inside the the brand new screen)

- Simply click to help you email address a link to a friend (Opens up in the the newest windows)

- Simply click to share with you to your Sms (Opens up when you look at the the latest screen)

- Simply click to copy hook (Opens in the fresh new windows)

The next-one-fourth financials to own Pennymac Economic Properties teach the latest twice-edged sword regarding declining interest rates having mortgage organizations. It does increase loan development and you can purchases but hurt the servicing profiles.

4 million out of July to Sep. Which was lower than their $98 mil funds on next quarter regarding 2024, based on filings into the Bonds and you can Replace Payment (SEC) toward Saturday.

Which have lower cost and a lot more chances to refinance mortgages, Pennymac made an effective pretax earnings away from $108 billion for the Q3 2024 in manufacturing sector, up out of $41.step 3 billion inside the Q2 2024 and you can $25.2 million when you look at the Q3 2023.

This was a reflection out-of so much more volume as opposed to highest margins. In total, financing purchases and you may originations had an unpaid prominent equilibrium (UPB) regarding $29.seven million into the Q3, up 17% one-fourth more than quarter and twenty-six% season more than year.

Because of the phase, manufacturing in correspondent channel improved 19% on a good quarterly basis to $28.step 3 mil inside the Q3 2024, that have margins ascending out-of 29 foundation what to 33 bps. Regarding the representative route, volumes rose 23.2% from the next one-fourth to arrive $5.step 3 million, however, margins fell of 103 bps so you’re able to 97 bps. The consumer head channel got a ninety-five% upsurge in production so you’re able to $5.dos mil, having margins declining out-of 393 bps in order to 323 bps.

After you re-finance a home loan, what happens?

Over the course of your mortgage, lifetime you are going to alter drastically. 5 years immediately after closure the ideal mortgage is almost certainly not therefore primary anymore. You don’t need to be caught, even though. If you’ve been expenses your loan of for many ages now, you’re a candidate for refinancing.

But when you re-finance a mortgage, what takes place? Refinancing fundamentally enables you to transfer your current financing to a different you to definitely, paying off their amazing financing and you may entering into a separate price with the exact same or another bank. You re-enter the financing market together with your current circumstances. If for example the cash have improved otherwise your home has exploded inside worth, it is not an awful idea to begin with looking around some other alternatives. Refinancing keeps a lot of methods, very why don’t we enter the important points. From your own home loan pros within Solarity Credit Union, this is what happens when you re-finance home financing.

Getting the credit history in check

Just as once you received the 1st home loan, you ought to be considered so you can re-finance.

What Expenses Must i Pay that have Signature loans inside Peoria, IL?

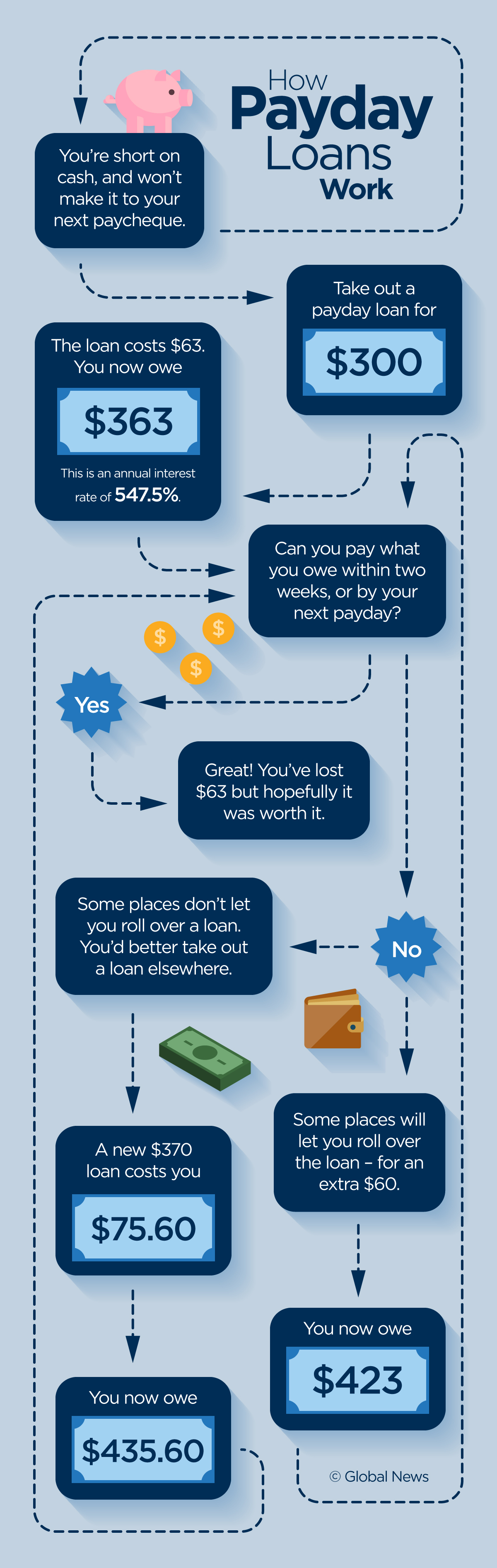

Fiscal experts commonly reference payday loans just like the predatory funds while the the loan words shall be misleading and unfair. Of several borrowers have problems with issues paying off its pay day loan because the attention costs are way too high. Private repayment loans provide decent prices that will be in balance.

Fees Size

Borrowers use an online payday loan to fund expenditures ranging from paydays. Individuals just receive two weeks to expend straight back its payday loans, that is insufficient. When a debtor does not deliver the full loan amount and you may attract fees contained in this that point, the mortgage moves over, and borrower must pay even more will set you back. Personal loans has actually flexible cost lengths. You can discover a couple months if you don’t many years to invest right back the borrowed money.

One benefit out of private payment funds is that you are able to use your lent money for your debts. You do not have to reveal the reason why you you desire economic recovery since there are no paying limitations. Check out suggests individuals used their consumer loan profit Peoria, IL.

Auto Repairs

Auto fixes could cost some money or a few thousand bucks. The expense of an auto resolve hinges on the vehicle pieces requisite, damage, and you can work. Extremely auto solutions are caused by an accident otherwise shortage of maintenance. Suppose you took your car to help you an auto technician and you will had a keen imagine off $dos,000.

Key Similarities Ranging from Individual Lenders And Financial institutions

Personal loan providers constantly costs large interest levels than simply finance companies. For the reason that the danger that they’re taking up after they bring financing, such as for example to people that have a reduced oriented credit score.

Finance companies have straight down rates of interest than just personal lenders every day. For the reason that they have usage of straight down-rates funds, and they’ve got the capacity to bequeath chance round the a large customer base.

Collateral

Individual lenders deal with a leading exposure once they lend financing. Very, they generally require some form of security, to decrease so it chance. Regarding real estate investors, the home itself may be used since collateral to help you hold https://paydayloancolorado.net/silver-plume/ the loan in the event the debtor usually do not repay it.

Banks need collateral getting an interest rate also, but there are numerous means of getting that it security.

What the results are When a lender Needs Fixes

The house-to buy techniques is full of expectation and you can adventure, however, sometimes, unanticipated difficulties may appear. One particular hiccup is when a loan provider states fixes with the a great assets till the financing are signed. So it requisite commonly originates from the house examination or perhaps the assessment report, that could imply certain conditions that the financial institution deems needed seriously to address on shelter and soundness of the property.

As an instance, in the event the a resident when you look at the Brand new Berlin try looking to promote the household fast, the fresh bottom line one bank-required repairs must be done can lead to unanticipated delays. If lender raises these types of inquiries, the fresh purchases procedure you will stall up until the called for fixes is actually finished. This is exactly simply because this new lender’s main goal is always to guarantee the latest security (our house) protecting the loan financing retains their value.

The brand new lender’s insistence in these fixes was grounded on the will to safeguard its capital. When significant architectural affairs, water damage, or even pest infestations try thought, it will reduce the new house’s market price, causing potential losses for both the bank and also the homeowner.

This is certainly particularly important in the places that the genuine house market is extremely aggressive. For example, homeowners trying browse the Shorewood industry carry out take advantage of facts exactly how we pick property when you look at the Shorewood qualities can help such points.