16 3: Progressive, Proportional, and Regressive Taxes

For example, the revenue from a progressive tax system can be used to fund education, healthcare, and affordable housing initiatives. In the context of taxation, this means that those with more should pay more taxes than those with less. Progressive taxation is seen as a way to achieve distributive justice by redistributing wealth from the rich to the poor. Policymakers must consider the predicted tax incidence when creating them. If taxes fall on an unintended party, it may not achieve its intended objective and may not be fair.

The Pros and Cons of a Progressive Tax Policy

Individuals in 14 states are charged the same proportional tax rate regardless of how much income they earn as of 2024. A proportional or flat tax system assesses the same tax rate for everyone regardless of income or wealth. https://etoprosto.ru/companies/?companies=127 This system is meant to create equality between marginal tax rates and average tax rates paid. The U.S. has a progressive income tax system that taxes higher-income individuals more heavily than lower-income individuals.

- Like a regressive tax, a flat income tax system imposes the same percentage tax rate on everyone regardless of income.

- Tax rates and tax liabilities increase with an individual’s wealth.

- These taxes were levied against land, homes and other real estate, slaves, animals, personal items and monetary wealth.

- It would levy a 2% tax on assets above $50 million, rising to 3% on assets above $1 billion.

- It imposes a lower tax rate on low-income earners and a higher rate on those with higher incomes.

Understanding Progressive, Regressive, and Flat Taxes

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. She has years of experience in SEO-optimized content creation and focuses on personal finance, investing and banking. If a producer is inelastic, he will produce the same quantity no matter what the price. If the consumer is elastic, the consumer is very sensitive to price.

Excise Taxes and Fees on Wireless Services Increased 8.8 Percent in 2024

Marginal tax rates refer to the tax rate applied to each additional dollar of income earned. In a progressive tax system, marginal tax rates are higher for those with higher incomes. This means that high-income earners pay a higher tax rate on each additional dollar they earn, which helps to reduce income inequality.

Because the consumer is elastic, the quantity change is significant. Because the producer is inelastic, the price does not change much. The producer is unable to pass the tax onto the consumer and the tax incidence falls on the producer. In this example, the tax is collected from the producer and https://psyhology-perm.ru/news/index3152.html the producer bears the tax burden. Many states have a flat income tax rate, including Arizona, Colorado, Idaho, Illinois, Indiana, Kentucky, Michigan, Mississippi, North Carolina, Pennsylvania, and Utah. Most others have a progressive state income tax, while a few have no income tax at all.

The percentage rate increases at intervals as taxable income increases. Each dollar the individual earns places them into a bracket or category that results in a higher tax rate when earnings meet the next threshold. A progressive tax is a tax in which the tax rate increases as the taxable base amount increases. The term “progressive” describes a distribution effect on income or expenditure, referring to the way the rate progresses from low to high, where the average tax rate is less than the marginal tax rate.

- Proponents of progressive tax systems consider them to be advantageous because progressive taxes lower the tax burden on citizens who can least afford to pay taxes.

- Third-party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness or fitness of this data for any particular purpose.

- The Federal Insurance Contributions Act (FICA) tax that funds Social Security and Medicare is often considered to be a flat tax because all wage earners pay the same percentage.

- If they spent $5,000 of their annual income on taxable consumer goods and lived in a state with a 6% sales tax (slightly below the national average), they would spend just under 2% of their income in taxes.

I’m a Retiree: 4 Reasons I Don’t Want Trump To Eliminate Income Taxes

Those with higher incomes have more money left after paying for the things they need, so they shoulder more of the burden for programs that benefit everyone. The federal income tax in the United States is a progressive tax. There are six tax brackets, and the one you fall into depends on your income. Taxes are calculated based on each income tier for people in every bracket except the lowest. Someone earning $600,000 per year would pay 10% on the first $11,000 they earned, 12% on the next $34,725, and so on. As a taxpayer’s income increases, so does the percentage of income tax they pay.

The term can be applied to individual taxes or to a tax system as a whole; a year, multi-year, or lifetime. Progressive taxes are imposed in an attempt to reduce the tax incidence of people with a lower ability-to-pay, as such taxes shift the incidence increasingly to those with a higher ability-to-pay. The opposite of a progressive tax is a regressive tax, where the relative tax rate or burden increases as an individual’s ability to pay it decreases. Most nations, including the U.S., feature both progressive and regressive tax systems. For example, our income tax system is progressive because it imposes a lower tax rate on low-income earners than on those with a higher income. Tax brackets group taxpayers by income ranges, and high-income taxpayers pay a larger share of the overall tax burden than low-income taxpayers.

Mark would pay much more in federal income tax than John due to his higher income and, thus, ability to pay. While there are a few ways to calculate effective tax rate, the simplest way is to divide you total tax by your taxable http://www.swpluscpu.com/product_hp-compaq-adapter-65w-for-business-notebook-series.html income. TurboTax calculates effective tax rate in a more sophisticated way by adjusting for various recaptured taxes and tax credits. Progressive, regressive, and flat taxes are all different tax systems governments can deploy.

There are ongoing debates about the merits of progressive tax systems. Some argue they are necessary to promote economic fairness, while others say they stifle economic growth and innovation. While a progressive tax system has several benefits, it also faces criticism for potentially disincentivizing high-income earners, encouraging tax evasion, and being complex and challenging to administer. Flat tax systems are often criticized for being regressive, as they burden low-income earners more.

In economics, tax incidence is the analysis of the effect of a particular tax on the distribution of economic welfare. There are several different tax brackets, or groupings, of taxable income, which are taxed at different rates. With a progressive tax, the person with the lower income would pay a lower tax rate than the person with higher income. An example would be if one person earns $12,000 in a year, and another person earns $120,000.

A progressive tax is one of two main types of tax systems used by a country. Under a progressive tax system, taxes are based on a taxpayer’s ability to pay. A progressive tax is when the tax rate you pay increases as your income rises.

Millimetre Wikipedia

It is a small unit of measurement compared to the centimeter, meter, inches, and feet we what does mm mean are familiar with. It’s important to note that the meaning of mm from a girl is not significantly different from how everyone else uses it. It is primarily used to express agreement, refusal, recommendation, or as a greeting in pagan culture.

Word History

- We can use the following chart to find the approximate results for the conversion of customary units.

- Length is measured in millimetres (mm), centimetres (cm), metres (m) or kilometres (km).

- “Mm” is a simple way to say “Yes” or “I agree” within a text message—but this abbreviation may be a little confusing at first glance if you’ve never seen it before.

- We are expected to see an expansion of the wind field as this weakens and approaches Florida.

Weight is measured in grams (g) and kilograms (kg). Volume is measured in millilitres (ml) and litres (l). This table provides a summary of the Length or Distance units within their respective measurement systems. While the overall meaning of mm from a guy is similar to how girls use it, there may be slight variations in usage and interpretation based on individual communication styles and preferences. It’s always best to consider the context and tone of the conversation when trying to understand what a guy means when he uses mm.

Find a Conversion

However, it’s important to note that mm does not have a sexual connotation and is not offensive. It is a popular slang term used in online chat and text conversations to indicate agreement or understanding, or to say “welcome” or “goodbye” in pagan culture. We can use the following conversion chart to convert millimeters into different metric units of length.

More from Merriam-Webster on millimeter

The smallest unit of measuring length is Planck Length. In case you are wondering how to measure length in millimeters or how a length of a millimeter or 1 mm looks like, let’s check it out on a ruler. To measure in mm, hold a metric ruler against an object, count the number of whole cm of its length, and multiply by 10. “Mm” is a simple way to say “Yes” or “I agree” within a text message—but this abbreviation may be a little confusing at first glance if you’ve never seen it before.

We can use the conversion chart to convert 147.5 mm into cm. The SI base unit for length is the metre.1 metre is equal to 1000 mm. Some examples of objects having about 1 millimeter length areA sharp pencil point and the tip of a sewing needle are approximately 1 mm in length. As we can see in https://www.instagram.com/bookstime_inc the chart, from mm to cm, only one jump to the left is required. We can use the following chart to find the approximate results for the conversion of customary units.

Convert Millimeter to Other Length Units

« These necklaces serve as representations of her strength and inspiration, encapsulating the essence of her extraordinary career, » the jeweler wrote. I have seen one million represented by mn and also by m (both lower case). The metric system is used to measure the length, weight https://www.bookstime.com/ or volume of an object.

- This phrase originated from Wiccan witches and is often used in online chatrooms or text messages.

- Volume is measured in millilitres (ml) and litres (l).

- It is primarily used to express agreement, refusal, recommendation, or as a greeting in pagan culture.

- However, it’s important to note that “mm” does not have a sexual connotation and is not offensive.

- Weight is measured in grams (g) and kilograms (kg).

- I have seen one million represented by mn and also by m (both lower case).

Here, millimeters help us accurately express their length. Although an eyewall replacement cycle can reduce the category of a hurricane, we can also experience the expansion of the wind field. This means the hurricane force winds and tropical storm force winds begin to reach out over a larger area. Length is measured in millimetres (mm), centimetres (cm), metres (m) or kilometres (km). A millimeter is usually the smallest unit you can measure using a regular ruler. However, there are many units smaller than a millimeter.

How To Use Xero Accounting Software 13-Step Guide

The payroll overview is a comprehensive guide to take you through each step of the setup. You should reconcile weekly, if not daily, to ensure that your accounts are as accurate as possible. If you have a limited company, ensure that you have a registration number and registered office address.

Easily find contact details

Finally, if you work with one, ask your accountant to check your set up. They may need to add year-end conversion balances and can ensure that your year-to-date figures are as expected. Using Xero’s wide range of apps and add ons is a great way to streamline repetitive processes and save yourself some time.

Set up payment reminders

An accountant or bookkeeper who knows Xero can take care of the tricky stuff while you focus on running your business. Have a current view of your finances with your bank transactions flowing into Xero automatically. You also need to link to any active payment services to your what is a lessee definition meaning example Xero account.

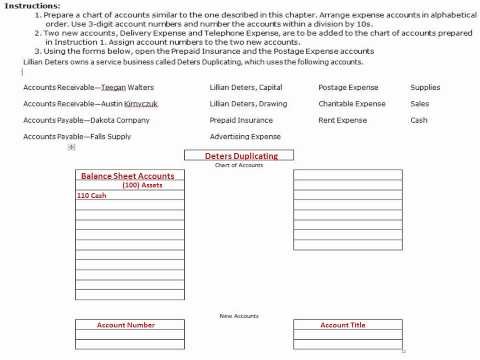

Set up your chart of accounts

Float is one of the highest-rated Xero apps available on the marketplace. It is an award-winning cash flow forecasting tool that creates accurate and visual reports for you, and your business. Float pulls through the bills and invoices from your accounting software, using them to populate your forecast on a rolling-basis. Float’s integration with Xero means no more manual data entry, 1120s entering charitable contributions and an always up-to-date and accurate forecast. Only set up payment reminders when you get into the habit of reconciling receipts daily.

Complete these lessons to learn how to customise and complete essential settings to get you started on Xero correctly from the outset. We recommend working with your accountant to bring account balances from your old system into Xero as conversion balances. Give your business partners and admin staff access to Xero to keep them informed and to share the workload. Initially, when you’ve input some data, look at your Balance Sheet, Profit And Loss, Aged Receivables, and Aged Payables. This function allows you to keep payroll costs in one place rather than having to pull in information from a separate system.

Xero is an online accounting software designed for small businesses. If you’re new to Xero, then this guide to getting started should help you quickly get up and running. Nailing down your terms of payment can help you to improve your cash flow. With the Xero Accounting app, you can do many day-to-day tasks including sending invoices and reconciling bank transactions. Add your customer and supplier contact details to Xero so they’re easily accessible online and you can look them up any time. Xero offers apps with a wide range of functionalities from cash flow ultimate guide to small business finance management forecasting, to document management, and many more.

Chasing payment from customers that have already paid can tarnish your reputation. You can come back to this step once daily reconciliation is part of your routine. Send online invoices and give customers easy online payment options that encourage them to pay there and then.

- Nailing down your terms of payment can help you to improve your cash flow.

- If you are transferring payroll from another system in the middle of the financial year – don’t forget to add the opening balances.

- If you’re new to Xero, then this guide to getting started should help you quickly get up and running.

Setting up payment reminders and organising your credit control systems can help you to get paid faster. If you are transferring payroll from another system in the middle of the financial year – don’t forget to add the opening balances. Just a few minutes a week spent approving pre-matched items ensures your data is up to date. As Xero is connected to your bank, transactions are pulled through automatically. Xero remembers the last time you categorised a transaction, so you can simply click ‘OK’ if you want it to go to the same category. If your business has employees, payroll in Xero makes it easy to keep pay records and get pay runs sorted.

With a clear picture of your cash comes the ability to make better business decisions and avoid falling behind on outstanding payments. If you have an accountant, you can seek their help with this decision. However, if you are your own bookkeeper then we recommend using Xero’s default chart of accounts. You can add, customise, or delete these accounts to match the needs of your business.

Here are 13 steps to get you started using Xero to get a better handle on your finances.

Ecommerce Accounting: A Beginners Guide for 2024

QuickBooks user-friendly accounting software is designed with its customers in mind. It’s not enough to draw visitors to your site; you’ll need to provide an engaging and easy-to-use website that reflects your brand and products. Create a clean, visually attractive site design and include compelling content that breaking down reconciliation is both original and benefit-focused. Ensure your site is easy to navigate and feature fast load times.

Get live expertise

- Connect your e-commerce platforms and marketplaces with a quick and easy setup, and start seeing your income and expenses all in one place.

- Customers should be able to search using a few keywords and find what they need.

- This includes metrics like cash flow and gross profits, balance sheets, and profit and loss (P&L) statements.

- There’s the day your product is market-ready, the day you open your online store to the world, and the day you make your first sale—a major step that calls for celebration.

Tax management can be complicated, and mistakes in filing or interpreting the tax code can have serious consequences for business owners. That’s why tax activity based management management (including both tax planning and preparation) is a core service of many accounting firms. As integration technology evolves, complete solutions are now available to connect your eCommerce store with QuickBooks in a real-time environment. These types of robust management platforms give you access to your data and control of your business processes.

Give your sales funnel a boost

Hard-to-find information, lack of buttons, and fiscal year definition too many fonts and colors can quickly frustrate customers—leading to no sale. Create simple navigation and use best practices to get the most out of your site. To nail it, you’ll also need to focus on how your site is built, how images are tagged, and what data is scraped by search bots, like Google.

Are you a current customer in need of support?

We never stop working to find new, innovative ways to make that possible. Please visit us at Intuit.com and find us on social for the latest information about Intuit and our products and services. About Intuit Intuit is the global financial technology platform that powers prosperity for the people and communities we serve. For those just starting out, the term “sales funnel” might be anew one.

What do ecommerce business owners need to keep track of?

Try Shopify for free, and explore all the tools you need to start, run, and grow your business. Join millions of self-starters in getting business resources, tips, and inspiring stories in your inbox. It’s a waste of time, and resource draining to experiment with various partial integration solutions like these. While the internet levels the playing field for everyone to participate in the retail game, winning your market is still determined by how well you play. No matter how small or large your retail operation is, you won’t be able to compete in the fast pace race of online shopping if you don’t integrate.

Offer a variety of shipping methods in terms of delivery time and price. It’s hard for a customer to justify making a purchase if there’s only one shipping option and it costs as much as the item they’re buying. Be it phone, text, or chat; make it simple for customers to speak with you. Learn how to set up credit card processing on your website correctly.

You can select the Orders tab in QuickBooks to view individual sales orders. While you can view your orders and the details of each order, you can’t download them into your QuickBooks Online accounts. Your inventory and products aren’t uploaded to your sales channels. You can continue to track your inventory in QuickBooks Online. QuickBooks Commerce is unparalleled in its accounting features because it’s built out of QuickBooks Online software.

(QuickBooks Commerce is not an ecommerce platform and requires you to connect an online store.) But then, with the power of QuickBooks behind it, you can fulfill orders in a breeze. Plus, QuickBooks Commerce lets you sell online and in a brick-and-mortar store. Let’s look at the top small business accounting software you can use in your ecommerce business. For example, the aforementioned coffee-table maker would “earn” $800 as soon as she finished her table, for example—but her business bank account might still be empty. For accounting purposes, this debt only matters once the money leaves your account. Ecommerce accounting also includes running financial reports such as profit and loss statements and cash flow statements.

Solved: How do I clear delete undeposited funds from the bank deposit?

Organize your transactions by grouping them based on common criteria, such as payment dates or customer names. This can help streamline the process of selecting payments in the next step when creating the bank deposit. After saving the bank deposit, QuickBooks Online will create a new transaction that represents the deposit in your bank account. Review the transaction details to ensure accuracy, and make any necessary adjustments or additions. Fixing undeposited funds in QuickBooks Online requires a systematic approach to identify and resolve any discrepancies or issues related to pending payments and deposits. Undeposited funds in QuickBooks Online can cause confusion and inaccuracies in your financial records if not properly managed.

Making any necessary adjustments at this stage will help avoid complications and errors during reconciliation. Whether you are new to QuickBooks Online or looking to optimize your bookkeeping workflow, this guide will equip you with the knowledge and tools to effectively manage and clear undeposited funds. Accurate record-keeping is essential to ensure that the deletions are properly accounted for in financial reports and compliant with regulatory requirements. You can make sure your financial data are accurate by pulling up the Reconciliation report. This will also let you access your individual reconciliation reports and check their accuracy. I’m here to share details on how a reconciled deposit affects your account balance when deleting one in QuickBooks Online (QBO), @benappy.

Your projects are processes,

- Undeposited funds help in aligning cash flow management, allowing for better forecasting and strategic decision-making.

- I cannot delete a deposit, or a payment from a deposit that is waiting to be recorded.

- I’m here to share details on how a reconciled deposit affects your account balance when deleting one in QuickBooks Online (QBO), @benappy.

- In this comprehensive article, we will delve into the intricacies of managing undeposited funds in QuickBooks, both in the online and desktop versions.

- This approach fosters financial accuracy and simplifies the overall management of business finances, promoting a healthy financial flow within the organization.

In your case, it appears that you matched the payments with the bank deposit downloaded via Banking Feeds, which explains why the deposits on your bank statement were cleared. Now, to clear the balance in your Undeposited Funds account, we have two options to avoid duplicate deposits. Once you are confident that all the information in the bank deposit form is accurate, you can proceed to finalize the deposit. Take a final moment to review the total deposit amount displayed at the bottom of the form, ensuring that it aligns with the total of the selected payments. This will open the bank deposit form where you can enter the details of your deposit.

Step 3: Create a new Bank Deposit

When you receive a payment from a customer, QuickBooks automatically assigns it to the undeposited funds account, rather than directly to your bank account. Clearing undeposited funds in QuickBooks Desktop involves specific procedures and steps to ensure accurate reconciliation of pending payments and deposits within the desktop software. Verifying the undeposited funds account is crucial in the process of fixing discrepancies, ensuring that all pending payments are accurately recorded and accounted for in QuickBooks Online. This process enables businesses to reconcile their accounts effectively, providing a clear picture of all pending transactions and their eventual deposit into the bank. It plays a pivotal role in maintaining financial transparency, aiding in the smooth functioning of the clearing process in QuickBooks Online.

Utilizing adjusting entry for bad debts expense undeposited funds in Quickbooks contributes to enhanced financial management, streamlined cash flow, and efficient handling of financial transactions within the system. Moving money from undeposited funds in Quickbooks Online involves creating bank deposits and transferring the funds from the undeposited account to the appropriate bank account within the system. After that, record a bank deposit so that you can combine the transactions from your Undeposited funds account and match them to your deposit in bank feeds.

Method 2: Dummy Bank Account Process

When you’re ready to clear undeposited funds, you will create a new bank deposit in QuickBooks Online. Clearing out undeposited funds in QuickBooks involves specific procedures and steps to ensure accurate reconciliation of pending payments and deposits within the software. The reconciliation of accounts is a fundamental step in fixing undeposited funds in QuickBooks Online, ensuring that all financial records align with actual transactions and deposits. It is essential to begin by reconciling all open invoices with the corresponding bank deposits. Ensure that each payment is correctly linked to a deposit in the Undeposited Funds account. In case of any discrepancies, double-check the payment and deposit entries to ensure accuracy.

You can edit the individual payment details within the bank deposit form by clicking on the respective field. As you select payments, you will see the total amount accumulating at the bottom of the bank deposit form. This provides you with real-time feedback on the total funds that will be moved and recorded in the bank deposit. If you for how to fill in irs form 7004 notice any discrepancies or errors in the records, such as duplicate payments or incorrect amounts, take the necessary steps to resolve them. This may involve deleting or correcting transactions, contacting the customer for clarification, or reaching out to your accountant for guidance. Identifying and addressing duplicate transactions can significantly contribute to fixing undeposited funds in QuickBooks Online, ensuring accuracy and consistency in financial records.

This process streamlines the bank reconciliation process and ensures that the company’s financial records what is the direct write off method accurately reflect the transactions. By ensuring timely recording of deposits and appropriately categorizing transactions, businesses can maintain a clear and up-to-date financial picture. Neglecting undeposited funds may lead to discrepancies in financial reporting, making it challenging to reconcile accounts and accurately assess the true financial position. Once you are satisfied with the transaction details, save the transaction to record the bank deposit successfully in QuickBooks Online.

In QuickBooks, the undeposited funds account is an automatically generated feature that acts as a virtual space for storing payment information received from clients. When a payment is made via check or any type of sale receipt, the amount is initially added to this account. This process is crucial for maintaining accurate financial records and facilitating proper reconciliation. Following these steps will enable you to effectively clear undeposited funds in QuickBooks Online, ensuring that your customer payments are properly recorded and deposited into your bank account. Regularly performing this task will keep your financial records accurate and up to date. After recording the bank deposit in QuickBooks Online, it’s important to take the final step of verifying that the undeposited funds have been cleared.

Simplify Payroll: The Ultimate Guide to Outsourced Services

The PEO will manage payroll and other administrative services, and will often also offer employee benefits. It may also offer services for employees in multiple how many years can you file back taxes states or even multiple countries. Bambee combines HR outsourcing services and software to provide a basic system to manage payroll and labor law compliance.

Run payroll around the world from one platform, streamline international operations, and eliminate the ongoing admin of local compliance, taxes, benefits, and more. Having an international team increases innovation, creativity, and diversity—but it also complicates payroll management. You have to navigate different currencies, exchange rates, bank laws, and compliance requirements.

ADP helps companies manage payroll taxes by automating deductions from employee wages and making sure the right amount of money is delivered to the government, based on the latest payroll tax rules and regulations. A New York- or San Francisco-based company that keeps payroll in-house, for example, must pay “big city salaries” to attract the right employees for managing payroll, just like the rest of its internal workforce. If many hours of work can instead be assumed by third-party employees somewhere with a lower cost of living, the outsourced functions tend to become cheaper to perform. “Payroll co-sourcing” describes a hybrid model in which some elements of the payroll process are hired away while others are completed in-house. When selecting an outsourced payroll provider, consider your budget, expansion goals, and payroll team’s bandwidth. Whether you’re running payroll domestically or internationally, you must ensure you’re operating in compliance with the employee’s payroll laws.

Users say the software is extremely easy to use and has comprehensive features. They also say TriNet’s customer support is responsive (responding within just minutes of inquiry submission) and knowledgeable. However, they do not like that the platform experiences frequent reporting glitches and they wish it offered more integration options. TriNet’s standout features include automated tax and filing support, unlimited payroll runs, a mobile app and time and attendance tracking.

It also includes managing information relevant to the tax process such as health insurance and workers’ compensation claims. Ensuring that your payroll partner has top-quality security measures in place is therefore one of the most vital factors to account for in your selection process. According to HR Dive, 61% of respondents outsourced payroll processing in 2022. And what are the pros and cons of taking this step for your business?

How do I choose the best accounting software for my business?

If you’re just using software, either the tool can pay your people or it can’t. There are plenty of features, functionalities and benefits that a given business might need from their payroll support vendor. We’ve focused on just a few, to highlight some of the most common (and most commonly needed) answers to HR and payroll pain points. Faster, easier, more reliable HR and payroll solutions designed to help you focus on what matters. You need comprehensive payroll and HR solutions that empower your people and unlock your teams’ potential. Any systems that must sync to derive this data, such as time clock software or systems, happen fair value vs market value automatically, so I didn’t have to worry about any of those processes.

- Wave doesn’t offer benefits administration, a major drawback, but its recent purchases of companies across the financial sector and its 2019 acquisition by H&R Block promise more capabilities and features to come.

- And, with the ability to pause the subscription, it is great for service companies such as landscapers who hire contractors often and endure off-seasons.

- From this screen, I was also given the option to import time tracking data from ADP’s time and attendance add-on or another time keeping software.

- If your current system causes frequent mistakes, you may want to consider outsourcing your payroll.

Are you a software provider looking to add more value to your tech?

Sometimes, you just need someone to take a few things off your hands. Business activities like running payroll are, obviously, a bit more involved and sensitive than, say, having someone run your personal mail to the post office. That said, at a fundamental level, outsourcing payroll or leveraging HR software solutions are in many ways the same as hiring someone to do your yardwork.

Top benefits of outsourcing payroll services

However, they say that the software does not offer enough customization options, nor does it offer detailed reporting to meet their needs. They also say its customer support is unhelpful; the chat bot does not offer relevant solutions and when they email customer support, it often doesn’t, either. They say the limited features the platform offers makes it a good option for companies with five to 10 employees but no more. TriNet has a 3.8 and 4.0 star review on Capterra and G2 respectively, with 649 user reviews total.

Take Your Time

“What made Deel stand out for SafetyWing was the extreme focus on the customer and how friendly and easy it is to use the platform. Definitely the best I have seen in this category,” said Karl Schroeder, Head of Finance at SafetyWing. SafetyWing is a health insurance provider for remote workers and teams. Payroll errors can negatively impact your workers, disrupting their budgets and lives and causing unnecessary stress. Payroll mistakes and delays can also dilute their trust and positive perception of your organization and lead them to question your financial status and management capabilities. Processing payroll and maintaining compliance standards is machine studying difficult for overwhelmed payroll departments, especially if their organization is growing quickly.

Payroll management can be complex, time-consuming, resource-intensive, and expensive. Plus, getting payroll in-house wrong can lead to severe implications ranging from financial penalties to negative employee experiences. Rather than having an in-house team deposit paychecks, calculate tax withholdings, and file your small business taxes, outsourced payroll handles it all behind the scenes.

Interest payable Definition, Explanation, Journal entry, Example

The accounts payable (AP) department is responsible for implementing the entire accounts payable process. The department is also a key driver in supporting the organization as a whole when it comes to vendor payments, approvals, and reconciliations. Financial statements also include current assets, which include cash and balances that will be paid within 12 months. Also referred to as a “p.o.” A multi-copy form prepared by the company that is ordering goods. The form will specify the items being ordered, the quantity, price, and terms.

To meet this need, it issues a 6 month 15% note payable to a lender on November 1, 2020 and collects $500,000 cash from him on the same day. Maria will repay the principal amount of debt plus interest @ 15% on April 30, 2021, on which the note payable will come due. Therefore, the number of days needed by the company to complete supplier invoices is estimated to be ~110 days on average, as of Year 0. The economic incentive structure for a company managing its accounts payable is distinct from the aforementioned. As a matter of fact, the two are conceptually contradictory to each other. The fewer customer payments owed to a company, the less liquidity risk attributable to a company (and vice versa).

Interest payable on balance sheet

The outstanding obligation to fulfill the payment in the form of cash to the supplier or vendor for the product or service navigating a changing bond markets received is anticipated to be paid in-full within the next 30 to 90 days. The outstanding payment owed to suppliers and vendors by a business will remain constant until the payment obligation is fulfilled (i.e. the payment is paid for in-full via cash). If a company’s accounts payable balance grows, the company’s cash flow increases (and vice versa) — albeit, the obligation to pay in-full using cash is mandatory. A payable is created any time money is owed by a firm for services rendered or products provided that have not yet been paid for by the firm.

- A payable is created any time money is owed by a firm for services rendered or products provided that have not yet been paid for by the firm.

- When you provide goods or services on credit, the amounts due are recorded in accounts receivable until you receive payment.

- When using the indirect method to prepare the cash flow statement, the net increase or decrease in AP from the prior period appears in the top section, the cash flow from operating activities.

- Thus, when these payments are monitored, the firms make sure there is no delayed payment and the amount owed to lenders are paid to avoid any huge increase in the accumulated interest payment figures.

- Meanwhile, obligations to other companies, such as the company that cleans the restaurant’s staff uniforms, fall into the accounts payable category.

Is Accounts Payable a Current Liability?

Given the accounts payable balance as of the beginning of the accounting period, the two adjustments that impact the end of period balance is credit purchases and supplier payments. Receivables represent funds owed to the firm for services rendered and are booked as an asset. Accounts payable, on the other hand, represent funds that the firm owes to others and are considered a type of accrual.

And also, the interest expense that needs to be paid after December 31st won’t be considered, as we discussed earlier. Now, since the loan was taken on 1st August 2017, the interest expense that would come in the income statement of the year 2017 would be for five months. If the loan were taken on 1st January, then the interest expense for the year would have been for 12 months. In the calculation of interest payable, it is important to know the time for which the principal amount has been borrowed. If the entities want equity financing to know how much they would require paying for specific number of months, they can divide the annual interest figure by 12. The next step is to convert the rate of interest from percentage to decimal.

Receive the vendor invoices

The days payable outstanding (DPO) measures the number of days it takes for a company to complete a cash payment post-delivery of the product or service from the supplier or vendor. Upon receipt of the cash payment, the recorded accounts payable balance will reduce accordingly (and the balance sheet equation must remain true). The balance sheet, or “statement of financial position”, is one of the core financial statements that offers a snapshot of a company’s assets, liabilities and shareholders equity at a specific point in time. The credit balance reflects the total amount the company still owes to its suppliers or vendors for goods or services received but not yet paid for.

When it comes to calculating the interest payment figures, there is no specific interest payable formula. For this calculation, the normal mathematical equation to calculate the interests is used. However, there is a series of steps that must be followed to ensure the calculation is done accurately.

Trade payables constitute the money a company owes its vendors for inventory-related goods, such as business supplies or materials that are part of the inventory. All outstanding payments due to vendors are recorded in accounts payable. As a result, if anyone looks at the balance in accounts payable, they will see the total amount the business owes all of its vendors and short-term lenders. Accounts payable (AP), or « payables, » refers to a company’s short-term obligations owed to its creditors or suppliers, which have not yet been paid.

Differential Cost Definition, Example How to Calculate?

If the company earned $10,000 using the current marketing platforms, moving to the more advanced advertising platforms might result in a 40% revenue increase to $14,000. Among several alternatives, management opts for the most profitable one. Not always; companies also consider other factors like quality and impact on business before deciding.

- ABC Company is a telecom operator that primarily relies on newspaper ads and the company website for marketing.

- Overheads are variable to the extent of 25 per cent of the present amount.

- But, there is a need for special tools costing ₹ 600/- to meet additional orders’ production.

- Differential cost offers valuable insights into the profitability of specific business decisions, allowing organizations to align their financial strategies with the most cost-efficient and revenue-generating options available.

- It involves estimating cost differences either by replacing the existing operation or introducing new procedures.

The variable cost of manufacture between these levels is 15 paise per unit and fixed cost Rs. 40,000. Differential cost is the change in cost that results from adoption of an alternative course of action. It can be determined simply by subtracting cost of one alternative from cost of another alternative or from the cost at one level of activity, the cost at another level of activity. Direct material and labour will be constant for the special order.

It is a crucial concept in decision-making scenarios, as it helps businesses assess the additional costs incurred by choosing one alternative over another. By comparing the differential costs of various options, companies can make informed choices that align with their financial objectives. This analysis aids in optimizing resource allocation and maximizing profit potential. It serves as a fundamental component in understanding how costs vary as production levels change, providing insights into the cost structure of a business. By differentiating between variable and fixed costs, it aids in formulating accurate cost estimations and determining the drivers driving these cost fluctuations. This understanding is indispensable for devising effective cost reduction strategies, as it allows organizations to focus on the specific activities or resources that are the main contributors to cost variation.

Examples of Differential Cost

Relevant cost analysis ignores sunk tax credit vs tax deduction costs since they won’t change with the decision at hand. The components required by the main factory are to be increased by 20 per cent. The components factory can increase production upto 25 per cent without any additional labour force. Overheads are variable to the extent of 25 per cent of the present amount. Determination of the most profitable level of production and price.

Real-world applications illuminate the theory—consider how businesses determine the best route when faced with finance concierge for startups alternative choices in production or service delivery. From manufacturing industries choosing between material suppliers to service-oriented enterprises weighing new software investments, differential cost sits at the core of their strategic decision-making processes. Semi-variable expenses blend features of both fixed and variable costs. Costs like these change with the amount of production or sales but also include a static component.

How does a company use differential cost?

You compare what each option will cost you extra over the other. This method helps figure out which product gives you more value for your money. Understanding these mixed expenses is key to effective cost control and budget planning.

How can a company reduce its differential costs?

So, we consider only relevant costs affecting the decision variables. Managers also consider differential cost for equipment choices. Two machines might do the same job but have different maintenance and operation costs over time – these are indirect variable and fixed expenses related to running them each day. Unlike variable or marginal costs that adapt to activity levels, fixed expenses provide stability in financial planning but also pose a challenge during slow periods when revenues may not cover all operating costs.

Can you give an example of differential cost in business?

These include direct materials and labor required to make each unit. It also plays a significant role in determining the profitability of new product lines, optimizing resource allocation, and streamlining production processes. By considering the differential cost involved in different options, businesses can make evidence-based decisions that align with their strategic objectives. Differential cost analysis aids in identifying opportunities for cost reduction, driving operational efficiency, and ultimately enhancing the overall competitiveness of the business. The unique characteristic of semi-variable costs lies in their ability to change in relation to the level of production or activity, making it difficult to accurately predict their behavior.

A Guide to Amazon Seller Bookkeeping

Running an 8-figure business involves much of the same reporting, financial considerations, and risks as operating a 7-figure company just at a much larger scale. Did you know there are over 1.3 million accountants in the U.S alone as of 2020? The vast majority are generalist accountants that oversee https://x.com/BooksTimeInc financial record-keeping in local accounting firms.

Ways to Use AI & Automation to Grow Your Amazon Business

In that case, you’ll want to be sure you’re compliant with hiring laws and managing payroll correctly. Again, this is a situation where your accountant can lend a hand. Indirect costs are equally important to calculate as direct costs. Some of these aren’t as obvious when you think of the expenses that go into creating or reselling your products.

- All you do is combine your total COGS and operating expenses and then subtract that number from your net sales revenue.

- This ensures your bookkeeping is up-to-date and you have money sitting in a bank account ready to pay your taxes on time.

- Popular software that is available in this industry includes Quickbooks, Xero, MYOB, and Zoho Books.

- Automated accounting solutions can simplify the process of filing your taxes.

- Of course, this can be a regular accountant with a general scope of skills.

- These would be things like meals, travel, continuing education, consulting, product samples, and any one-time costs.

Know your business’s finances

- You can use FBA to fulfill all the products you sell, or some of them, depending on your needs.

- For example, let’s say we bought $15.89 worth of office supplies from OfficeDepot on January 18, 2021.

- The reality is you are setting yourself up for all kinds of financial reporting, compliance issues, and cash flow problems with this laissez faire approach.

- This includes collecting sales tax where necessary and understanding your obligations for income tax.

When you hire a professional bookkeeper, it takes all the stress and anxiety off your shoulders. You won’t need to worry about it being done, done on time, and done correctly. Plus, outsourcing this task allows you to focus on other aspects of your business that you likely find more enjoyable, such as product development and marketing.

The Basics of VAT for Shopify sellers 2024 Update

This includes tracking the number of returns, the reasons for the returns, and the total amount reimbursed. In other words, bookkeeping is the foundation upon which accounting is built. The advice you receive from your accountant and bookkeeper will only be as good as the information you share with them about your business, growth objectives, and challenges. For example, if you only give them basic information, they are going to provide you with more general advice and best practices.

Reconcile your bank statements

This requires a robust accounting system that can handle the complexities of ecommerce inventory management. Manual accounting can be prone to errors, such as data entry mistakes. Automated accounting solutions reduce the risk of these errors, ensuring your financial records are accurate and reliable. Additionally, Link My Books manages VAT and sales tax calculations, syncing this information with Xero for precise tax reporting and compliance. Download our ecommerce accounting tool kit and learn how to build a financial system to scale your amazon fba accounting business beyond 7 figures.

As a successful small business owner, you can’t do everything. If bookkeeping isn’t the best https://www.bookstime.com/articles/bookkeeping-san-francisco use of your time, let someone handle it for you. Bookkeeping services are even tax-deductible, making them an excellent business decision. You may reside in one state but have sales tax nexus in another, which means you’ll need to register for a sales tax permit in that state and collect sales tax from buyers in that state.

However, when it comes to taxes, it is generally better to be safe than sorry. If you can figure out what caused the spike in sales, you can then double down on what’s working.