No loan choices, with no choice into the affairs, bring what the supplier has actually

Most home buyers now get and you will, develop, try approved for their home loan. He or she is subject to latest lending conditions and you will interest rates.

Just a few people could only grab the mortgage that’s currently connected to the subject property because of the starting what exactly is entitled a beneficial “financing presumption.” A presumption is actually overtaking the burden for the loan that is already on the assets. Can you really do that?

Yes, in fact you might, however, there are specific constraints and you will logically not all family consumers will in reality have the ability to assume a loan.

The interest rate found is actually for a loan that have automatic money regarding an effective U

Consumer loan

S. Lender or external personal checking or checking account. ($twenty five,000 ‘s the max amount borrowed to own low-website subscribers.) The speed assumes on a beneficial FICO Score away from 760 or higher. Restrict financing numbers may differ because of the credit score. Loan approval is actually at the mercy of borrowing from the bank https://paydayloansconnecticut.com/pawcatuck/ acceptance and you may system advice. Rates of interest and you can program terms and conditions is subject to changes without warning.

Get the finance you need at once, that have a fixed price and you will fixed monthly obligations with the lives of the financing.

Home equity mortgage

The interest rate shown is actually for financing around 60% financing in order to value (LTV), getting website subscribers that have automatic money off a You.S. Bank individual examining otherwise family savings. The interest rate assumes on a FICO score out-of 730 or more. Costs can vary from the part and generally are susceptible to change. The newest monthly payment responsibility could well be deeper when the taxes and insurance rates come and you will an initial consumer put may be needed in the event that an enthusiastic escrow account for these materials is done.

Get the finance need at once. You have the safety out-of repaired-rate money to your dominant and you may attention into the lifetime of the fresh mortgage.

House security personal line of credit (HELOC)

The rate shown takes on a credit limit with that loan so you can worthy of (LTV) from sixty%, a FICO score from 730 or higher and you can a great U.S.

Logistics off Amortization Times For easy Desire Mortgages

Hard-backup amortization dates aren’t designed for effortless attention mortgage loans since the new strategies are too solid. However, a virtual substitute when it comes to a spreadsheet is available in the Keeping track of Amortization out of an easy Attention Mortgage.

« I’ve a simple desire home loan and wish to create an enthusiastic amortization agenda. We known as bank, however they don’t possess you to definitely, and they did not learn how to recommend myself about how precisely in order to determine one to. »

An easy appeal financial is one on which interest rates are calculated each day in the place of monthly. Towards the a beneficial 6% mortgage, such as for example, .06 was split up of the 365 to locate a daily speed from .016438%. That is increased of the harmony each and every day so you’re able to calculate new everyday interest. On month-to-month accrual funds, however, .06 was split up of the several to find a monthly price regarding .005, that’s increased of the equilibrium monthly to discover the month-to-month notice. For lots more, comprehend Just what are Simple Notice Mortgage loans?

If you’re amortization dates are often released away to have monthly accrual loans, I have not witnessed one having an easy interest loan. The newest logistics are just also formidable.

Brand new PPP Consumers: Very first Mark PPP FAQ section

Performs this FAQ affect me personally?

Which FAQ relates to your if you have never ever in the past obtained a PPP Mortgage regarding any lender. To learn more, kindly visit the small Company Administration web site (SBA.gov).

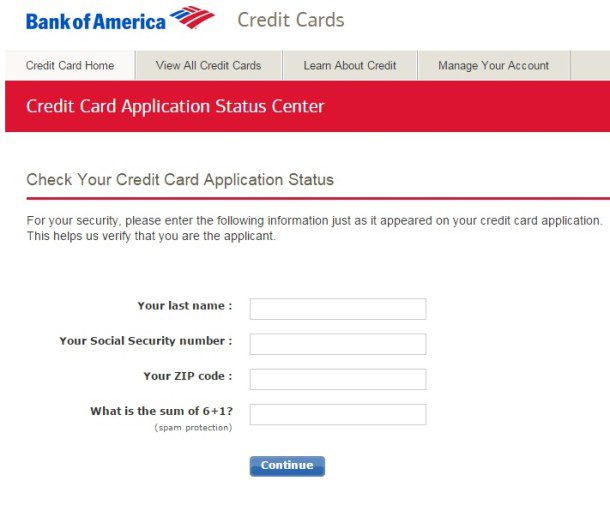

How do i apply for an excellent PPP loan with Watertown Deals Bank?

Our company is recognizing SBA PPP Loan applications to own review through our WSB PPP App portal. Immediately after reviewed and pre-passed by WSB, completed software are going to be submitted because of the WSB to the Business Association (SBA) to possess authoritative approval performing towards the Monday, January 19th. So it webpage have a tendency to lead your throughout your PPP Application for the loan.

If you are not currently an effective WSB buyers, up on entry of the software, we are going to need you to unlock a WSB family savings. This may allow us to do the regulators-necessary identity and you will files measures necessary to offer the mortgage. In case the financing is approved, we are going to financing your SBA financing using this account. You are not as much as no obligations to continue to make use of the fresh new account shortly after financing investment and you are not necessary to-be a good WSB buyers to try to get a good PPP Financing.

Exactly what assistance am i going to have when trying to get a PPP Financing?

New WSB PPP Software portal often take you step-by-step through the fresh new PPP application processes. Meanwhile, so it FAQ was created so that you will know the way PPP loans performs and that have the ability to choose all the info one will be required from you whenever obtaining a beneficial PPP Financing.