To buy Property During the Part thirteen Bankruptcy proceeding For the Texas

Lives will not stop simply because some one goes because of bankruptcy. Essentially, the fresh debtor’s existence efficinternet explorerncy on track immediately following a bankruptcy proceeding instance is actually recorded. But not, lifestyle does not usually come back to “normal” and debtors is generally up against of a lot informal trouble.

What will happen, for-instance, if the borrower must flow and purchase a home just before their Section 13 bankruptcy proceeding is finished? Could i pick a property if someone is certainly going due to Part thirteen bankruptcy proceeding?

What is actually Part 13 Bankruptcy?

Chapter 13 bankruptcy proceeding is recognized as an effective reorganization version of personal bankruptcy. The brand new borrower works together with the personal bankruptcy trustee to arrange a beneficial intend to pay-off the brand new licensed costs. That it payment plan months normally lasts between three to five years, and at the end of that time, any leftover delinquent expense was discharged.

Pleased New year!- Here is a homes Feedback to have 2023!

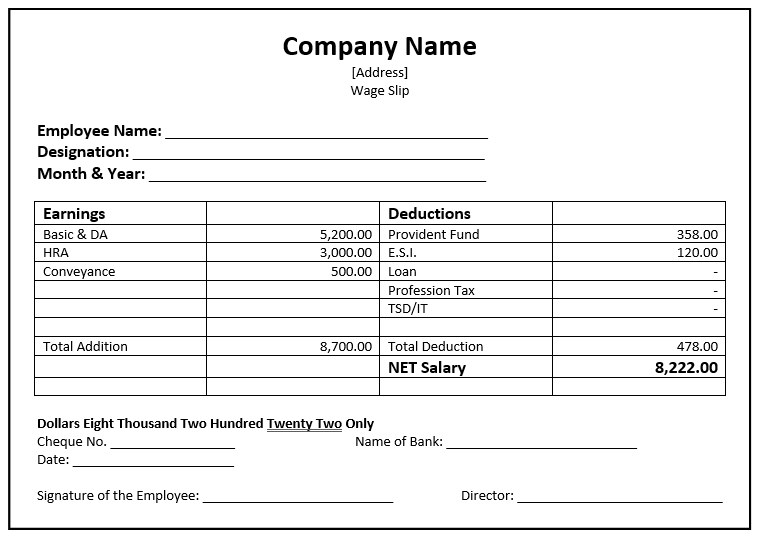

Outlining Closure Rates

If you are purchasing a separate household, remember that the advance payment is not the simply costs that you need on closing go out. Settlement costs try expenses to set up your own financial. Many buyers do not take into account the closure cost whenever imagine the amount of money they want for their new house. I do want to explain closure cost for you and many guidance on the best way to cure those prices.

You may need fund to pay an enthusiastic appraiser, citizen insurance provider, tile business, income tax enthusiast, and you may credit file, all in inclusion on lender on their own

The settlement costs you will need to pay confidence the newest type of loan you’re taking and you will in your geographical area. However, generally closing costs tends to make up to 5% of your own loan amount. Consequently by firmly taking away home financing really worth $two hundred,000, we offer settlement costs are doing $10,000. That rates will likely be estimated when you get a beneficial pre-acceptance letter on lender.

Closing costs never become your own down payment but can getting discussed. Each other people and you may sellers shell out settlement costs. The buyer always will pay several. You might discuss with a seller to help safety closing costs Providers can only just lead as much as a particular portion of the latest amount borrowed, according to the sort of mortgage.

For many home loans, you will shell out the closing costs during the closure conference, the lending company welcomes your down-payment funds and everything you you would like to expend to summarize will set you back. You might be able to save very well your own closing costs because of the handling the loan founder. You can also should ask your merchant to invest a beneficial portion of the settlement costs and take a no-closing-pricing financing.