Fundamentally, in 2020, Guild Financial paid off money out-of $24.9 mil into United states having neglecting to realize FHA financing recommendations, knowingly giving risky fund and you may collecting FHA financial insurance rates when said loans defaulted.

While we usually try to include exact or over-to-date details about regulating and you may lawsuits, we do not claim this information is complete otherwise totally to date. I encourage you do your look, also.

Guild Mortgage’s The means to access

Guild Home loan works for borrowers who want the ease provided from the digital tools (on the payday loans Moores Mill internet pre-degree, electronic papers and you can faster running) but don’t want to sacrifice direct telecommunications with their financing administrator.

Supply

Guild Mortgage has over two hundred actual twigs from inside the 32 says and you may works with local financial institutions into the 48 claims and you will Arizona, D.C.

New lender’s on the internet application is built to hook up you to definitely a mortgage manager, who’ll show hence loan has the benefit of are available, given your debts.

Contact details

- (800) 365-4441 to own consumers that have a current Guild Financing for further issues.

- (800) 971-3864 for new people or general inquiries

- (800) 365-4884 into the lender’s Financing Guidance Service

User experience

Users can simply discover on the web explainers and you may instructions for every regarding Guild Mortgage’s mortgage situations, along with home loan calculators and you can an internet application.

If your applicant decides to proceed on the application for the loan, the loan administrator are working with these people to submit all of the pre-approval records digitally.

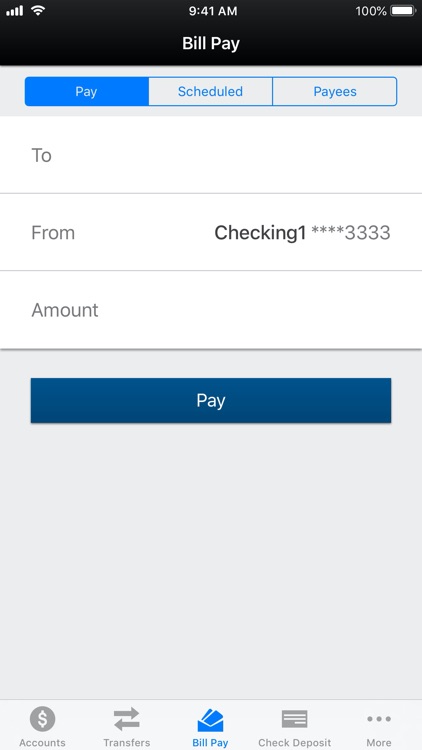

With respect to the financial, individuals is submit most closure records digitally and reduce the past in-individual closure to simply moments. Immediately following closure, home owners can fill in home loan repayments on the internet (a beneficial $eight surcharge may pertain) or as a consequence of ACH wire transmits (automated otherwise that-time) using their bank account.

Limits

Guild Mortgage’s on the internet help works away from 8:30 a.m to 4 p.yards PT and there is no email to possess concerns exterior that it plan. Also, the brand new speak serves users calling Guild Financial which have a certain goal (to order, refinancing otherwise repair a current loan), perhaps not general positioning.

- Guild-to-Wade connects real estate agents which have a great Guild Home loan administrator. Pages can also be recommend clients, generate pre-recognition letters and screen the borrowed funds process of beginning to end.

- My Loan Expert has the benefit of a pared-down types of the educational content and you may mortgage calculators found on your website and not much more. This new software are defectively examined online Play and Fruit Store due to its limited capability.

Guild Mortgage’s Customer care

Our very own search having customer happiness which have Guild Financial returned combined overall performance. The company gotten greatest results during the user satisfaction surveys, the User Economic Coverage Bureau (CFPB) noted numerous buyers problems.

I and discover buyers studies throughout the Bbb (BBB) and you may TrustPilot, however, members should be aware of that the take to measurements of such product reviews try really small (38 from the Bbb and just one in TrustPilot).

Customers Complaints

Out-of 2019 in order to 2022, customers registered 142 complaints against Guild Mortgage to the CFPB, with 123 ones 407 objections being related to financial things, particularly FHA-loans. Really says pertain to the brand new commission process products (missing payments, unanswered phone calls and you will issues with on line accounts and percentage networks).

Every issues filed into the 2022 was closed that have a quick response from the business, once the was in fact many states recorded in the past a couple decades.

Third-People Studies

J.D. Stamina, a strong you to analyzes consumer data all over various other areas, publishes annual customer happiness reviews predicated on a-1,000 part scale.

In the 2021 Guild Home loan obtained most readily useful ratings in 2 surveys: the fresh new U.S Pri U.S Pri, Guild Financial nonetheless obtained more than community mediocre but fell to help you sixth place in the loan Servicer Pleasure Research (prior to now known as U.S Top Home loan Servicer Analysis).